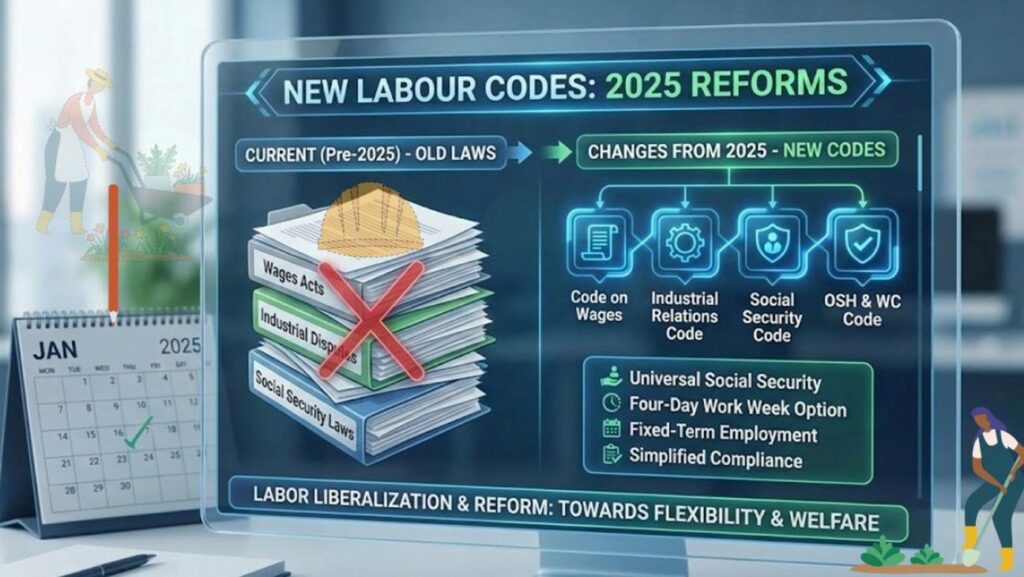

India’s New Labor Codes

A guide to the consolidation of 29 central labor laws into 4 unified codes, impacting wages, social security, & industrial compliance for employees & employers.

The 4 Pillars of Labor Reform

Understanding the industrial legislative framework.

Code on Wages (CoW)

Consolidates 4 wages laws. Introduces a statutory “Floor Wage” applicable across all states and defines a mandatory 50% Basic Pay Threshold.

Social Security Code (SSC)

Universalizes access to ESI and PF schemes. Provides specific, dedicated social security cover for Gig & Platform Workers via a new aggregator contribution fund.

Industrial Relations Code (IRC)

Increases the threshold for seeking government approval for layoffs/closures to 300 workers. Legalizes ‘Fixed Term Employment’ with pro-rata benefits.

OSH & WC Code

Consolidates laws on safety, health, and working conditions. Mandates Safety Committees in large establishments and grants women full working flexibility, including night shifts.

Key Impact on Employees

Understanding your new rights and salary structure for enhanced security

Critical Change: The New Definition of “Wages”

The Code on Wages standardizes the definition of ‘Wages’ to prevent employers from minimizing statutory contributions (PF, Gratuity) by paying low Basic Salary.

The 50% CTC Threshold Rule:

Total Remuneration (Basic Pay + DA) must constitute at least 50% of your total Cost to Company (CTC).

If excluded allowances (HRA, Bonus, etc.) exceed 50% of CTC, the excess amount is mandatorily added back to ‘Wages’ for statutory calculations.

Key Takeaway: This ensures a higher base for PF and Gratuity contributions, directly increasing your long-term retirement corpus and security.

Your future savings grow significantly, even if your immediate cash-in-hand changes slightly.

Higher “Wages” = Higher Retirement Benefits

Work Hours, Overtime & Leave

-

Overtime Rate: Mandatory payment at 2x the normal wage rate for work exceeding the daily limit (CoW).

-

4-Day Week: Permissible (if agreed), but maintains the 48 hours/week total (e.g., 4 x 12-hour shifts).

-

Women’s Shifts: Night shifts (7 PM – 6 AM) allowed with consent and mandatory safety and transport provided by the employer.

-

Annual Leave: Initial eligibility reduced to 180 days of service in the first year (down from 240 days).

Exit & Settlement Deadlines

Must be paid within a strict deadline of only 2 working days of resignation, termination, or layoff.

A unified 3-year window is established for filing all claims related to wages, bonus, gratuity, etc.

FTEs become eligible for pro-rata Gratuity after completing just one year of service.

Gig & Platform Workers: New Social Security

First-time legal recognition and dedicated welfare fund

Legal Coverage & Definitions

The Social Security Code legally defines these workers and includes them under a framework for welfare schemes, funded by a dedicated levy.

- Platform Workers: App-based drivers, delivery partners.

- Gig Workers: Freelancers outside the traditional employer-employee relationship.

The Aggregator Fund & Benefits

Aggregators are legally required to contribute a percentage of their turnover to a central social security fund.

(Capped at 5% of turnover per transaction)

- Health and Maternity Benefits

- Life and Disability Cover

- Old Age Protection (Pension)

Compliance & Flexibility for Employers

Key operational and legal changes for establishments

The “300 Employee Rule”

The threshold for retrenchment (layoff/closure) requiring prior government approval is increased from 100 to 300 employees, granting greater operational flexibility.

Fixed Term Employment (FTE)

Direct hiring for fixed tenure is simplified. FTE staff must receive equal wages and statutory benefits, including pro-rata gratuity.

Mandatory Health Checks

Employers must arrange and pay for mandatory annual health check-ups for employees who are 45 years of age or older (OSH Code).

One Compliance, One Return

Compliance is simplified: One License, One Return, and One Inspection. Physical records are reduced to 5 core digital registers.

Penalties Decriminalized

Minor procedural violations are decriminalized. Focus shifts to heavier financial fines (up to ₹1 Lakh) via an Adjudication Officer.

Centralized Registration

New establishments register electronically via a unified portal. A single registration number is used for compliance across all 4 codes.